Choosing the best credit cards for americans in the USA can be overwhelming. With hundreds of options offering cashback, reward points, travel perks, balance-transfer benefits, and no-annual-fee structures, understanding which card actually delivers value is crucial.

As we move into 2026, the U.S. credit cards market continues to evolve. Consumers now expect more rewards, flexible redemption options, travel upgrades, and transparency in fees. In this comprehensive guide, we have analyzed spending trends, category bonuses, and user benefits to help you find the Best Credit Cards for Americans in 2026 — based on real usability, not just marketing claims.

This article covers:

- What to look for before choosing a best credit cards

- The top 5 credit cards for U.S.A consumers in 2026

- Who each card is best suited for

- Tips for maximizing your rewards and improving credit health

Let’s dive in.

What Americans Should Consider Before Choosing a best Credit Cards 2026 Full Guide

Before jumping into the list, it’s important to understand the key factors U.S. consumers should evaluate:

1. Annual Fee

Some cards charge $0, while premium travel cards may cost over $400 per year.

The fee must justify the rewards and perks you actually use.

2. Rewards Rate & Bonus Categories

Credit cards offer:

- Flat-rate cashback

- Rotating rewards

- Category-based bonuses (travel, dining, groceries, gas)

- Flexible points that transfer to airlines/hotels

Choose a card aligned with your spending habits, not just flashy bonuses.

3. Welcome Bonuses

Most U.S. cards offer intro bonuses worth $200–$1000+ in the first 3 months.

Evaluate:

- Minimum spend requirement

- Redemption flexibility

- Bonus limits

4. Redemption Options

Some cards only allow cashback, while others allow:

- Airline miles

- Hotel points

- Travel credits

- Gift cards

- Statement credits

Flexible redemption = higher real-world value.

5. APR & Balance Transfer Terms

If you ever plan to carry a balance or refinance high-interest debt, consider:

- Intro 0% APR period

- Balance transfer fees

- Long-term interest rate

6. Your Credit Score

Top-tier cards often require Good to Excellent credit (700+).

Beginners or rebuilders will need secured or starter cards.

5 Best Credit Cards for Americans

Now that the criteria are clear, here are the best credit cards in the U.S.A for 2026, for different types of users.

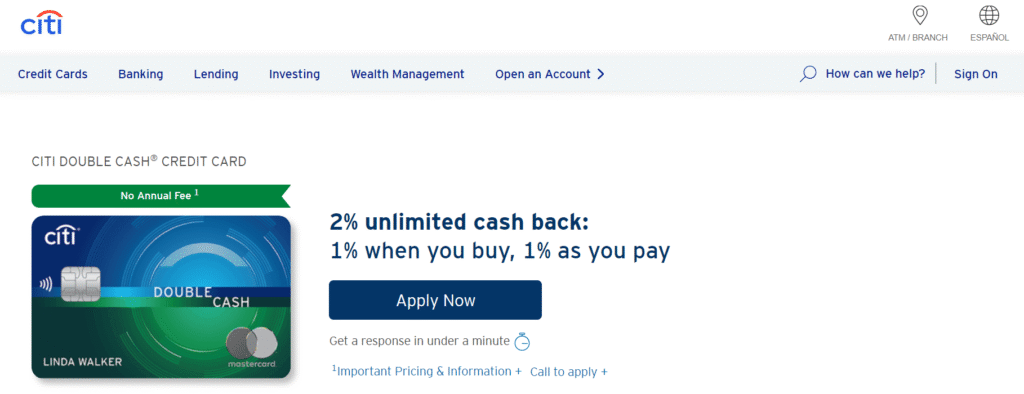

1. Citi® Double Cash Card — Best Overall No-Annual-Fee Card

Why It’s Great

The Citi Double Cash is one of the most practical credit cards for everyday use in the U.S. because it gives consistent value regardless of where you shop. Unlike category-based cards that offer rewards only in specific areas (like travel or dining), this one gives you a flat rate on everything, making it ideal for people who want simplicity. You don’t have to track rotating categories, sign up for bonuses, or worry about changing reward structures.

Key Benefits

- 2% total cashback (1% on purchase + 1% on payment):

This encourages responsible credit behavior. You earn more when you pay off purchases—helping build better spending habits. - No annual fee:

You get long-term value without worrying about “using it enough” to justify a fee. - Works for all spending categories:

Whether you’re buying groceries, gas, or paying bills, you earn the same rate everywhere. - Super beginner-friendly:

No need to understand complex reward programs; the value is straightforward.

Best For

- Everyday shoppers: Perfect for households spending across many categories.

- People who want one reliable card: If you hate juggling multiple cards, this one is a great all-rounder.

- Anyone avoiding annual fees: Ideal if you want rewards without paying extra every year.

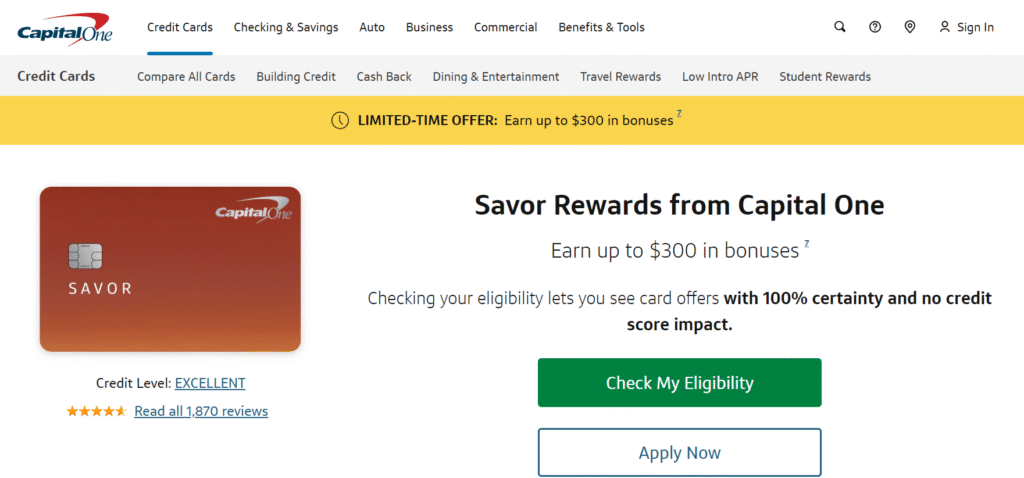

2. Capital One Savor Cash Rewards — Best for Dining & Entertainment

Why It’s Great

The Savor card is designed around modern American lifestyles. Eating out, streaming services, concerts, movies, and entertainment spending have grown rapidly in the past decade. This card rewards exactly those habits—making it a “lifestyle rewards card” rather than a general-purpose one.

Key Benefits

- High cashback on dining and entertainment:

If you’re someone who enjoys restaurant dining, takeouts, concerts, or movies regularly, you get far more cashback vs. standard cards. - Streaming bonuses:

Today, almost every American household has Netflix, Hulu, Disney+, Spotify, etc. This card maximizes cashback on these subscriptions. - Strong welcome bonus:

Many U.S. users earn their first $300–$500+ easily from intro bonuses. - Good for families and social lifestyles:

People with higher entertainment budgets get great long-term value.

Best For

- People who dine out often: Every restaurant visit adds up in rewards.

- Those who enjoy movies, concerts, and sports events: Entertainment cashback stacks fast.

- Families with streaming services: Ideal for homes with 3+ subscriptions.

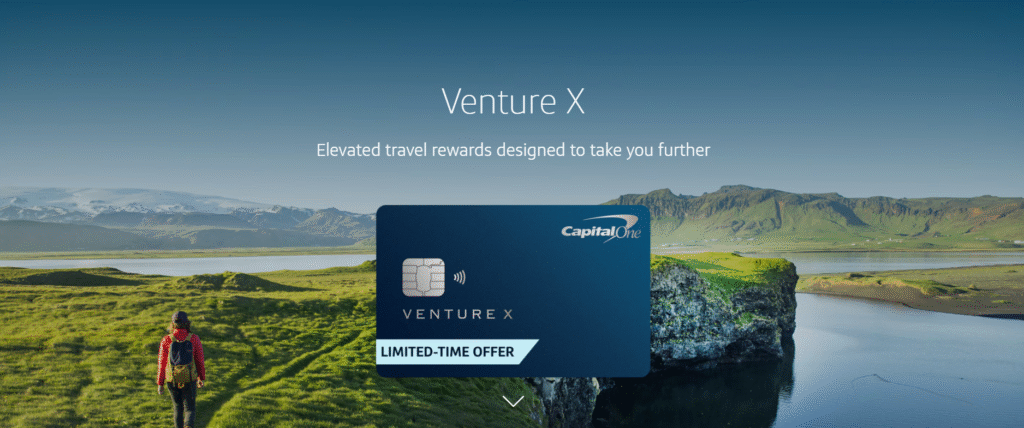

3. Capital One Venture X — Best Premium Travel Card for Americans in 2026

Why It’s Great

The Venture X has become one of the most loved travel cards in the United States because it offers premium benefits at a lower net cost compared to competitors like Amex Platinum. Even though it has an annual fee, the credits and perks easily outweigh the cost if you travel even twice a year.

Key Benefits

- Airport lounge access:

Gives access to Priority Pass lounges and Capital One lounges—saving $40–$60 per visit. - High-value travel miles:

Miles can be transferred to popular airlines and hotel partners for big savings. - Annual travel credit:

Usually $300–$400 per year, which significantly reduces your effective annual fee. - Travel protections:

Includes trip delay reimbursement, lost luggage insurance, and rental car coverage—highly valuable when traveling within the U.S. or abroad.

Best For

- Frequent travelers: Even 2–3 trips a year make this card worth it.

- People who want lounge access: Saves money and enhances airport comfort.

- Users who want premium travel perks but not super-high annual fees: Better value than most luxury cards.

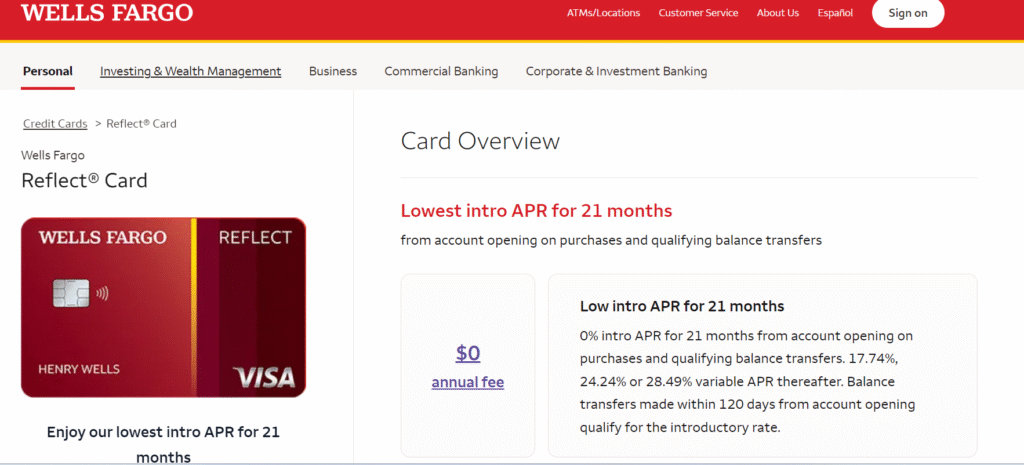

4. Wells Fargo Reflect® Card — Best for Balance Transfers & Low Interest

Why It’s Great

This card isn’t about rewards—it’s about saving money on interest, making it one of the most practical financial tools for Americans with debt. If you want to pay down existing credit card balances, the Reflect card’s long 0% introductory APR window is extremely beneficial.

Key Benefits

- One of the longest 0% APR periods in the U.S.:

Helps you pay down debt without accumulating interest, potentially saving hundreds or thousands of dollars. - Useful for big purchases:

If you’re buying appliances, furniture, or electronics in 2026, a long 0% intro APR means you can pay slowly without interest penalties. - Simple and clean design:

No tricky rewards or gimmicks—pure financial relief.

Best For

- People with credit card debt: You can consolidate high-interest cards into this one.

- Americans planning a major purchase: Avoid interest on big buys.

- Anyone looking to save money instead of earning rewards: Great for financial stabilization.

5. Discover it® Secured Card — Best for Building or Rebuilding Credit

Why It’s Great

This card is widely known as the best beginner-friendly card in the USA. It not only helps you build credit but also gives rewards—rare for secured cards. Discover is also famous for excellent customer support, making the journey easier for people new to credit.

Key Benefits

- Refundable security deposit:

You get your deposit back when you upgrade or close the account responsibly. - Cashback on purchases:

Even as a secured card, it gives rewards — which most beginner cards don’t provide. - Reports to all 3 major credit bureaus:

Essential for building a strong U.S. credit history. - Automatic upgrade review:

Discover reviews your account after 7 months to upgrade you to unsecured.

Best For

- Students starting credit: Great first card for young Americans.

- People rebuilding after hardship: Helps regain financial credibility.

- Immigrants or newcomers to the U.S.: Perfect for establishing credit from scratch.

Final Thoughts

When selecting the Best Credit Cards for Americans, there is no universal “perfect card.” The right choice depends entirely on your lifestyle, spending habits, and financial goals.

Quick Recommendations

- Best Overall: Citi Double Cash

- Best for Dining & Entertainment: Capital One Savor

- Best for Travelers: Capital One Venture X

- Best for Debt Management: Wells Fargo Reflect

- Best for Beginners: Discover it Secured

Tips to Maximize Value

- Pay your balance in full every month

- Take advantage of intro bonuses

- Use category-bonus cards strategically

- Check for travel or shopping protections

- Review your card benefits annually

Having the right credit card can save you $500–$2,000+ per year depending on how smartly you use it.

Frequently Asked Questions (FAQ)

1. What is the best credit cards for Americans in 2026? Overall…

The Citi Double Cash Card is the best all-round choice for most Americans because it offers simple, unlimited 2% cashback with no annual fee.

2. What is the best U.S. travel credit cards for 2026?

The Venture X is considered the best-value premium travel card due to lounge access, annual credits, and flexible airline/hotel transfer partners.

3. What is the best credit cards for paying off debt?

The Wells Fargo Reflect Card is ideal because it offers one of the longest 0% intro APR periods for balance transfers and purchases.

4. Do credit cards rewards expire?

Most major issuers in the U.S. allow rewards to remain active as long as your account stays open.

5. What credit score is required for premium U.S. credit cards?

Typically 700+ (Good to Excellent) is required for cards like Venture X or high-tier cashback cards.